However, hardship withdrawals are subject matter to cash flow tax and may incur a ten% penalty if taken in advance of age 59½. Not like a loan, hardship withdrawals can not be repaid for the plan.

The delivers that surface Within this table are from partnerships from which Investopedia receives compensation. This compensation may effect how and wherever listings surface. Investopedia does not incorporate all delivers accessible during the Market.

This is how they perform, the positives and negatives, and what to consider just before borrowing out of your retirement account.

Before you decide to get out a loan from a 401(k) and potentially jeopardize your retirement discounts, it’s imperative that you explore other available choices.

The delivers that surface Within this desk are from partnerships from which Investopedia gets payment. This compensation may effects how and exactly where listings seem. Investopedia doesn't contain all presents available in the marketplace.

This information is intended to become instructional and isn't customized into the expenditure demands of any particular Trader.

Depending on the stipulations of the 401(k) strategy, you may or may not manage to make further contributions while you’re in the process of shelling out back your loan.

Keep this in mind: A 401(k) loan is not the same point for a hardship withdrawal. With a hardship withdrawal, it's essential to show that you have an “instant and large money will need,” based on the IRS, and also the funds are closely taxed.

Everyday living won't always go In line with strategy, Which applies to funds way too. For several Americans, unanticipated health care expenses or just the accrued excess weight of significant-curiosity personal debt can develop fiscal pressure just when retirement cost savings need to be a top priority.

When you’ve observed qualifying for conventional loans difficult thanks to your credit score, a credit Examine-free of charge loan out of your 401(k) may very well be a saving grace.

The Forbes Advisor editorial staff is unbiased and goal. To assist assist our reporting work, and to continue our capability to offer this written content without cost to our audience, we acquire payment from the companies that publicize within the Forbes Advisor website. This compensation arises from two most important sources. First, we offer paid out placements to advertisers to present their presents. The payment we receive for anyone placements influences how and in which advertisers’ gives seem on the site. This site would not contain all organizations or items out there in the market place. Next, we also contain backlinks to advertisers’ provides in some of our posts; these “affiliate backlinks” may well produce earnings for our site any time you click them.

Double taxation entice. You repay 401(k) loans with immediately after-tax dollars that should be taxed once again when withdrawn in retirement. This means you’re properly paying taxes two times on exactly the same dollars.

Should you qualify for the HELOC, You may as well attract on those funds again after you’ve paid out the line back in total—you gained’t even really need to re-qualify.

"Borrowing from your 401(k) may be financially more info smarter than having out a cripplingly significant-fascination title loan, pawn, or payday loan—or even a a lot more affordable individual loan. It will set you back considerably less Eventually."

Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Brandy Then & Now!

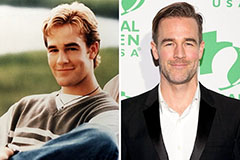

Brandy Then & Now! James Van Der Beek Then & Now!

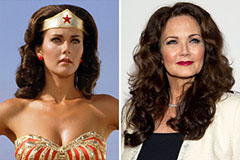

James Van Der Beek Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!